Fran Metrics

Blog

For Franchisors

& Franchisees

Get a Score Card, Dump the P&L!

In many cases, a franchisee-delivered profit and loss statement can be useless for both franchisees and franchisors. Why?

Many of the figures are not actionable. There is no differentiating between vital and non-vital data. Does anyone really need to know they paid the same rent last month as they paid the month before and they will pay again next month? Probably not.

It has lagging indicators, not leading indicators. Sales were down last month! It took you until the 15th to look at your P&L, and now the issue is as much as 45 days old! Could you be tracking specific numbers sooner and look at other figures that may have been causing lower sales, such as customer service scores?

It can be misleading. Most businesses have every incentive to make that bottom line as LOW as possible for tax purposes. Also, franchisees may have major repairs or other one-time expenses showing a result not related to their actual performance. Most people looking at a P&L go right to the bottom line and make an instant judgment without having the time to do a full investigation. Sure, the franchisee probably knows why, but the franchisor is most likely not going to have the conversation to figure out the issue.

It is missing other crucial data that you need to track. If you are taking the time to look at the unit level performance, shouldn’t you be looking at all the relevant data all in one place?

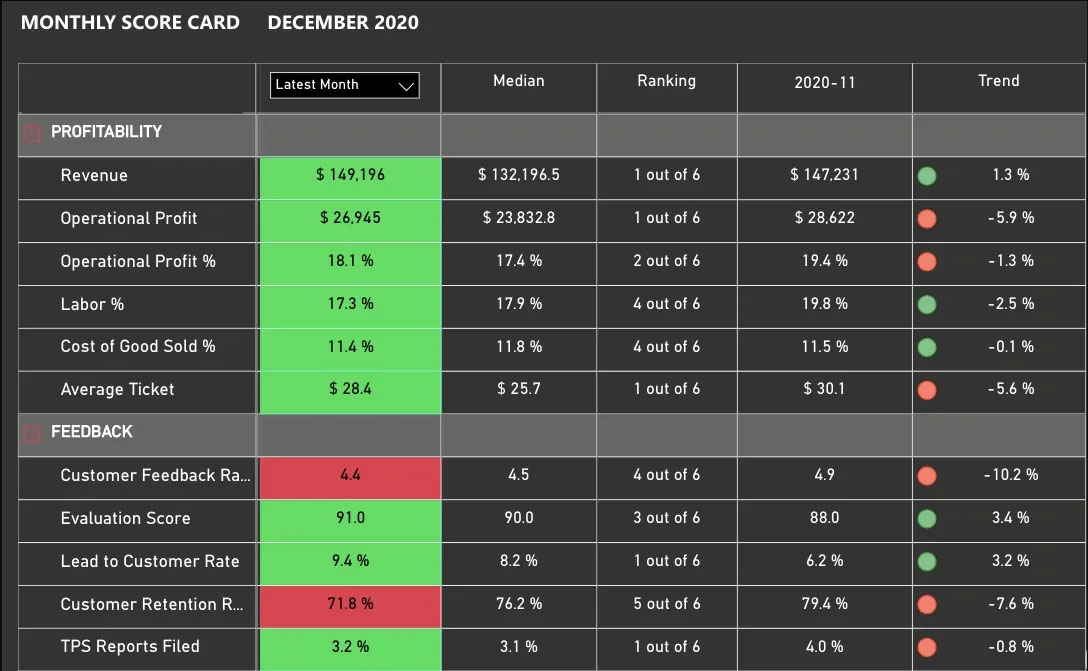

What you need is a scorecard!

Collect, compile and benchmark the most critical and actionable numbers (KPIs) that you can track on a per-unit basis. We recommend keeping the number of KPIs to less than 20. You can have weekly, daily, and monthly scorecards, depending on how you can collect and automate your data collection process and how quickly you need the data. It may appear that the actual PROFIT is being disregarded in this system, however, we recommend having an OPERATIONAL PROFIT as one of your KPIs. If you determine that certain items in your P&L are necessary to the franchise’s operation, they can be subtracted from the revenues to show an operational profit. This is one step past EBITDA and will give an apples-to-apples comparison, leaving out discretionary and other costs not associated with the operation like interest or depreciation.

Jason – Fran Metrics

Need a scorecard? Get a Fran Metrics demo!

Subscribe

In most cases we will reply within minutes,

if requested

Get in

Touch